Rowan County Nc Property Appraiser

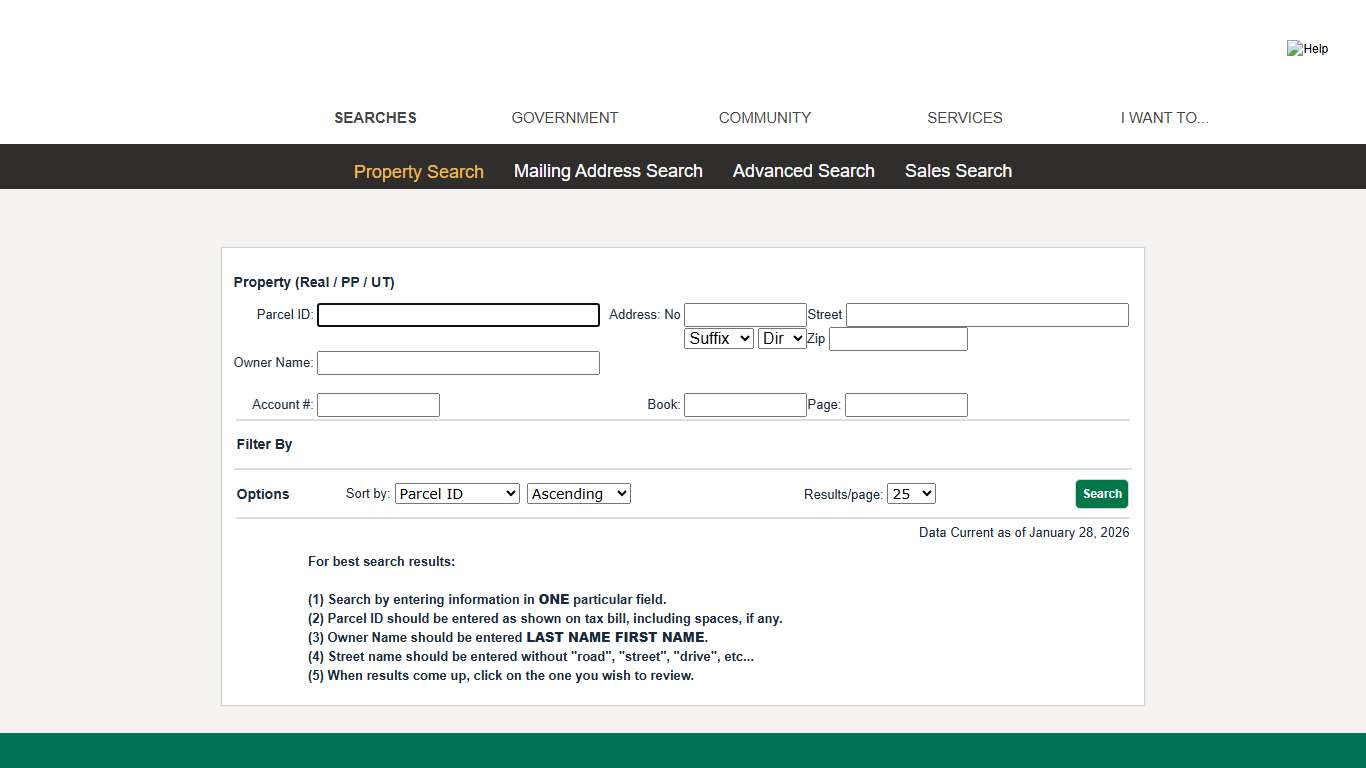

Rowan County - Property (Real / PP / UT) Search

704-216-8558 (Tax Assessor), Helpful Links Job Opportunities · Code of Ordinances · Permits ... 2025 by Rowan County, NC Last Updated: January 24, 2026.

https://tax.rowancountync.gov/

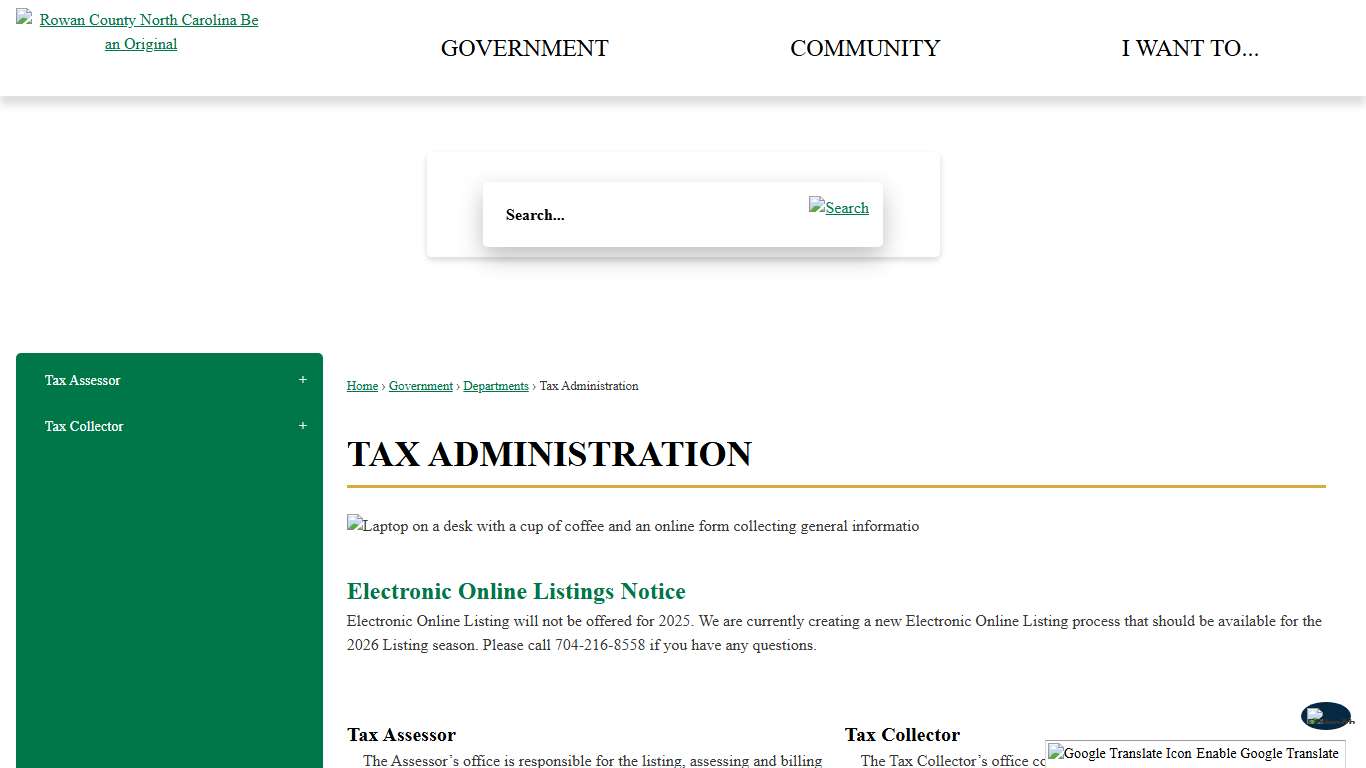

Tax Administration Rowan County

Electronic Online Listing will not be offered for 2025. We are currently creating a new Electronic Online Listing process that should be available for the 2026 Listing season. Please call 704-216-8558 if you have any questions.

https://www.rowancountync.gov/1139/Tax-Administration

AV-9 2026 Application for Property Tax Relief NCDOR

Some NCDOR offices may be closed to the public today. Please call ahead if you need to visit an office. Help is also available by calling 1-877-252-3052. A new tax on alternative nicotine products will also be imposed. Tax related to the rate change of product in inventory as of July 1 will apply.

https://www.ncdor.gov/av-9-2026-application-property-tax-relief

Business Personal Property Extension Request

The extension request form must be submitted to our oƯice no later than January 31, 2026. Approved extensions are granted through April 15, 2026. Tax Year: Date ...

https://www.rowancountync.gov/DocumentCenter/View/48702/2026-Business-Personal-Property-Extension-Request-Form-PDFReal Estate Appraisal in Salisbury, North Carolina 7046402228

As licensed appraisers, we possess the training and credentials to generate the type of reliable property value opinions that banks and national lending institutions require for mortgages. With years of experience under our belt, we're more than ready to handle practically any type of property.

https://grahamresidentialappraisalsinc2.appraiserxsites.com/

rowan county

Sales study will continue through December 31, 2026. PHASE 2: Commercial/Industrial field work, on-site review, and final valuations of ...

https://evp.nc.gov/_entity/annotation/032805b7-41ac-ef11-b8e9-001dd830a601/863ea987-6d3e-ed11-9daf-001dd805ec0b?t=1732665600265Rowan County, NC Property Tax Calculator 2025-2026

Calculate Your Rowan County Property Taxes Rowan County Tax Information How are Property Taxes Calculated in Rowan County? Property taxes in Rowan County, North Carolina are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.71% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/northcarolina/rowan-county

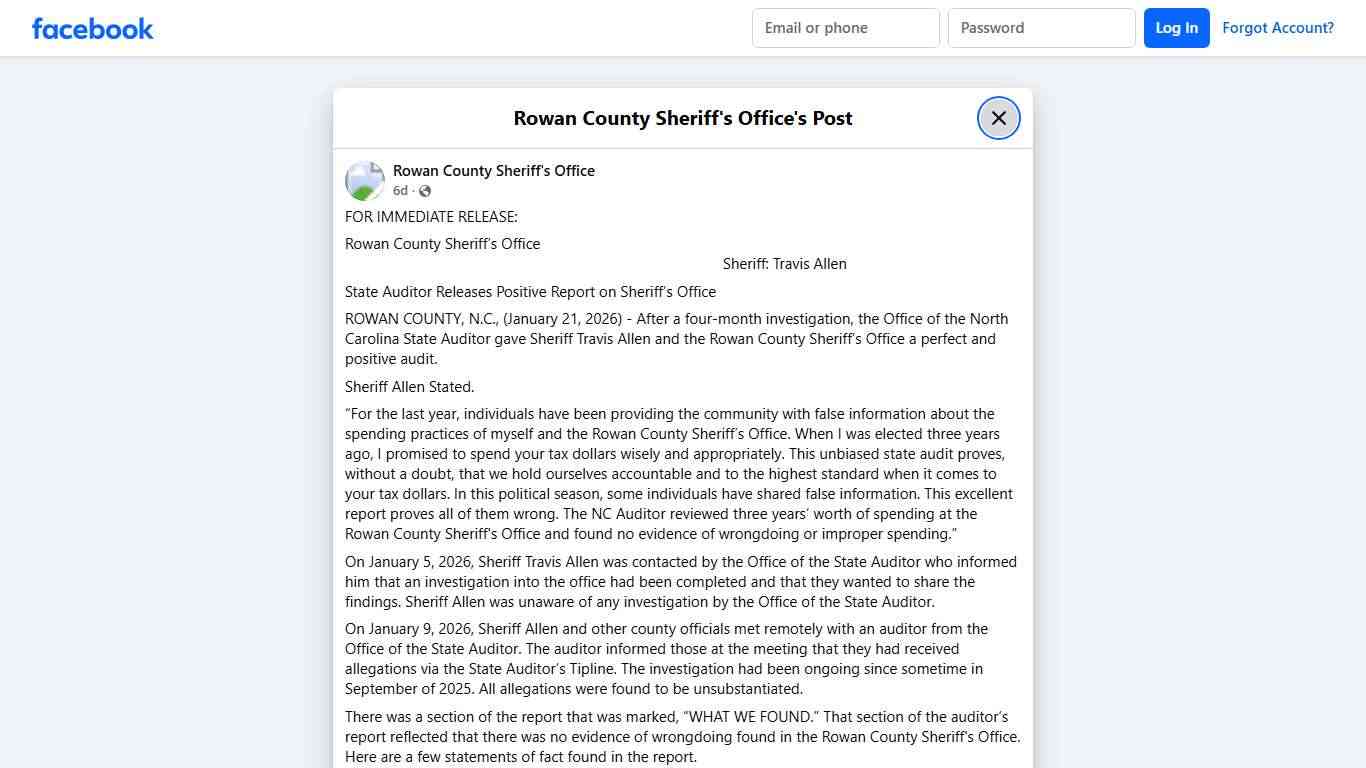

FOR IMMEDIATE RELEASE:... - Rowan County Sheriff's Office Facebook

Rowan County Sheriff’s Office Sheriff: Travis Allen State Auditor Releases Positive Report on Sheriff’s Office ROWAN COUNTY, N.C., (January 21, 2026) - After a four-month investigation, the Office of the North Carolina State Auditor gave Sheriff Travis Allen and the Rowan County Sheriff’s Office a perfect and positive audit.

https://www.facebook.com/rowancountyncsheriff/posts/for-immediate-releaserowan-county-sheriffs-office-sheriff-travis-allen-state-aud/858580873816736/

Rowan County, NC Property Records Owners, Deeds, Permits

Instant Access to Rowan County, NC Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Rowan County, North Carolina, encompasses eight towns, two cities, and a village.

https://northcarolina.propertychecker.com/rowan-county

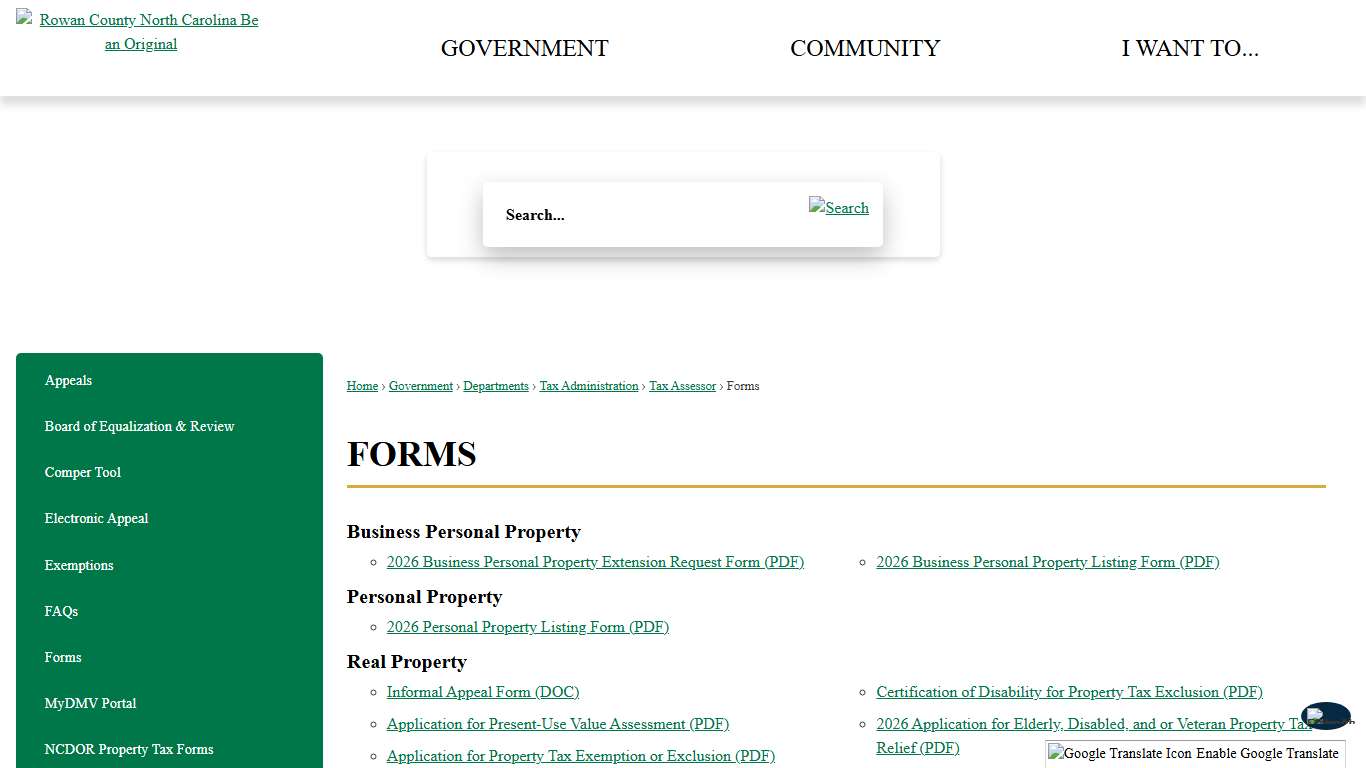

Forms Rowan County

View the various forms, applications and documents regarding the work of the County Assessor.

https://www.rowancountync.gov/483/Forms

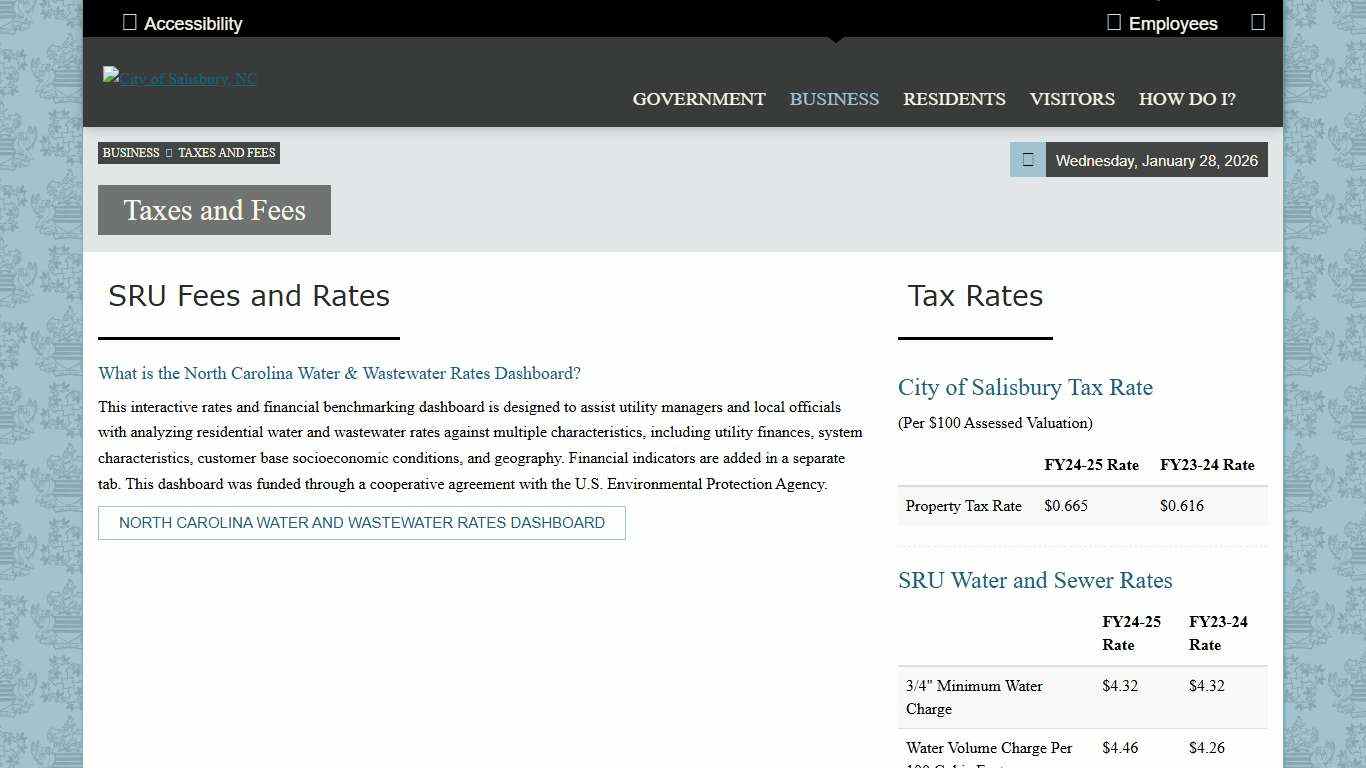

Taxes and Fees

What is the North Carolina Water & Wastewater Rates Dashboard? This interactive rates and financial benchmarking dashboard is designed to assist utility managers and local officials with analyzing residential water and wastewater rates against multiple characteristics, including utility finances, system characteristics, customer base socioeconomic conditions, and geography.

https://salisburync.gov/Business/Taxes-and-Fees

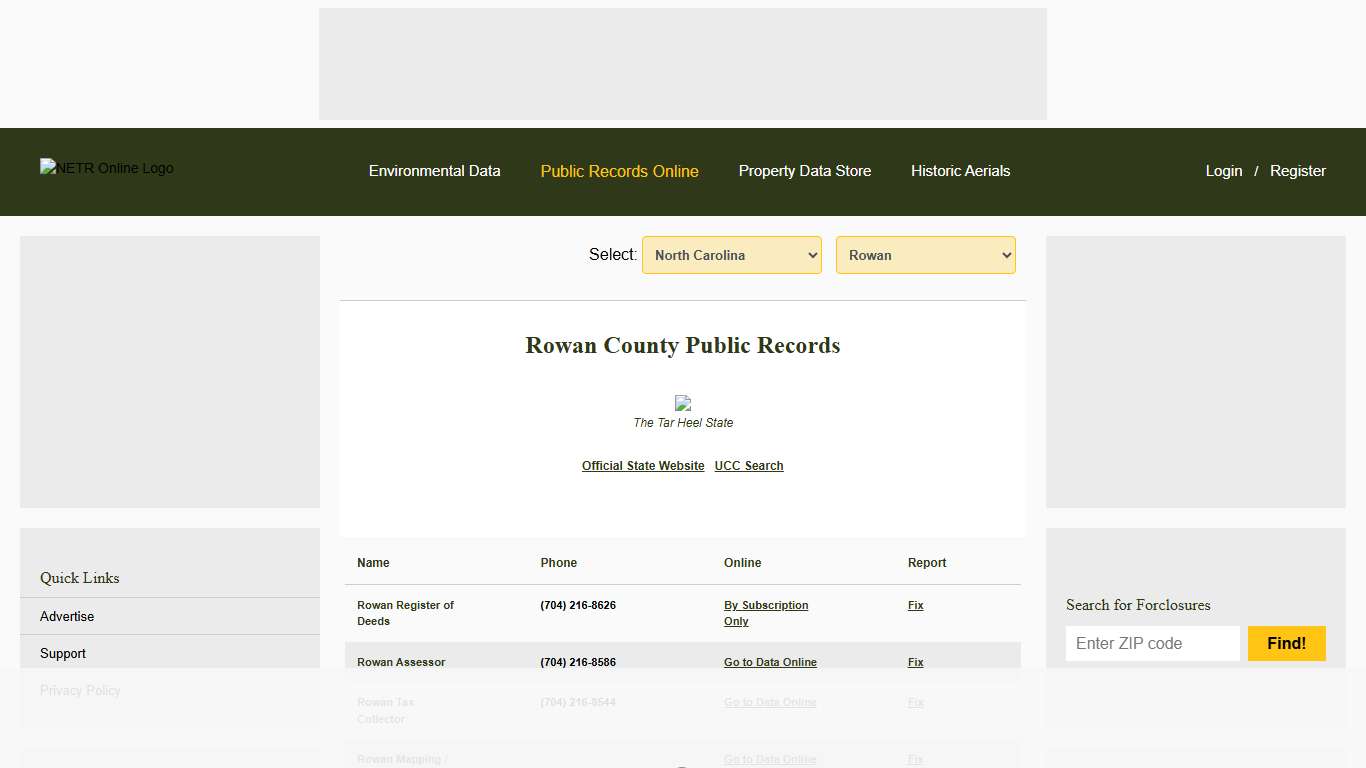

NETR Online • Rowan • Rowan Public Records, Search Rowan Records, Rowan Property Tax, North Carolina Property Search, North Carolina Assessor

Select: Rowan County Public Records The Tar Heel State Rowan Register of Deeds (704) 216-8626 Rowan Assessor (704) 216-8586 Rowan Tax Collector (704) 216-8544 Rowan NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store...

https://publicrecords.netronline.com/state/NC/county/rowan

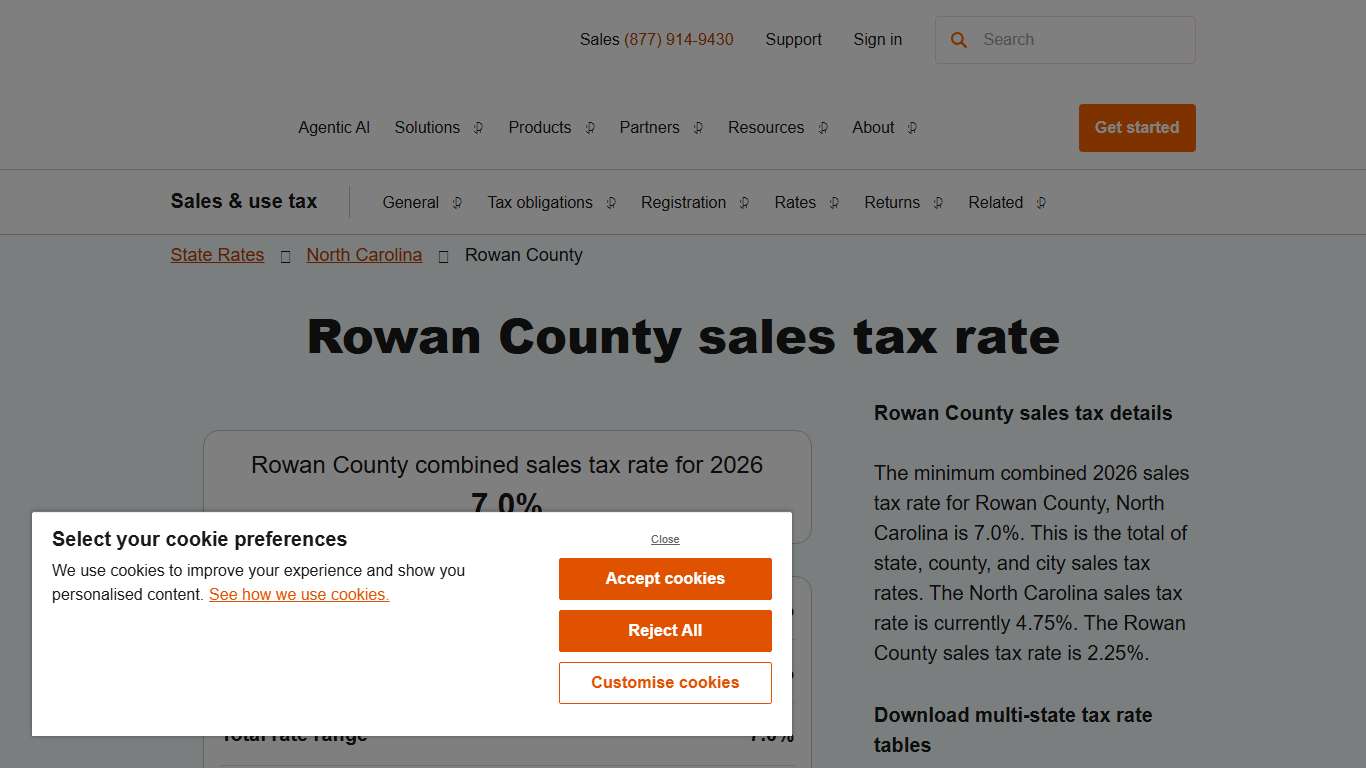

2026 Rowan County County Sales Tax Rate - Avalara

Rowan County sales tax details The minimum combined 2026 sales tax rate for Rowan County, North Carolina is 7.0%. This is the total of state, county, and city sales tax rates. The North Carolina sales tax rate is currently 4.75%. The Rowan County sales tax rate is 2.25%.

https://www.avalara.com/taxrates/en/state-rates/north-carolina/counties/rowan-county.html

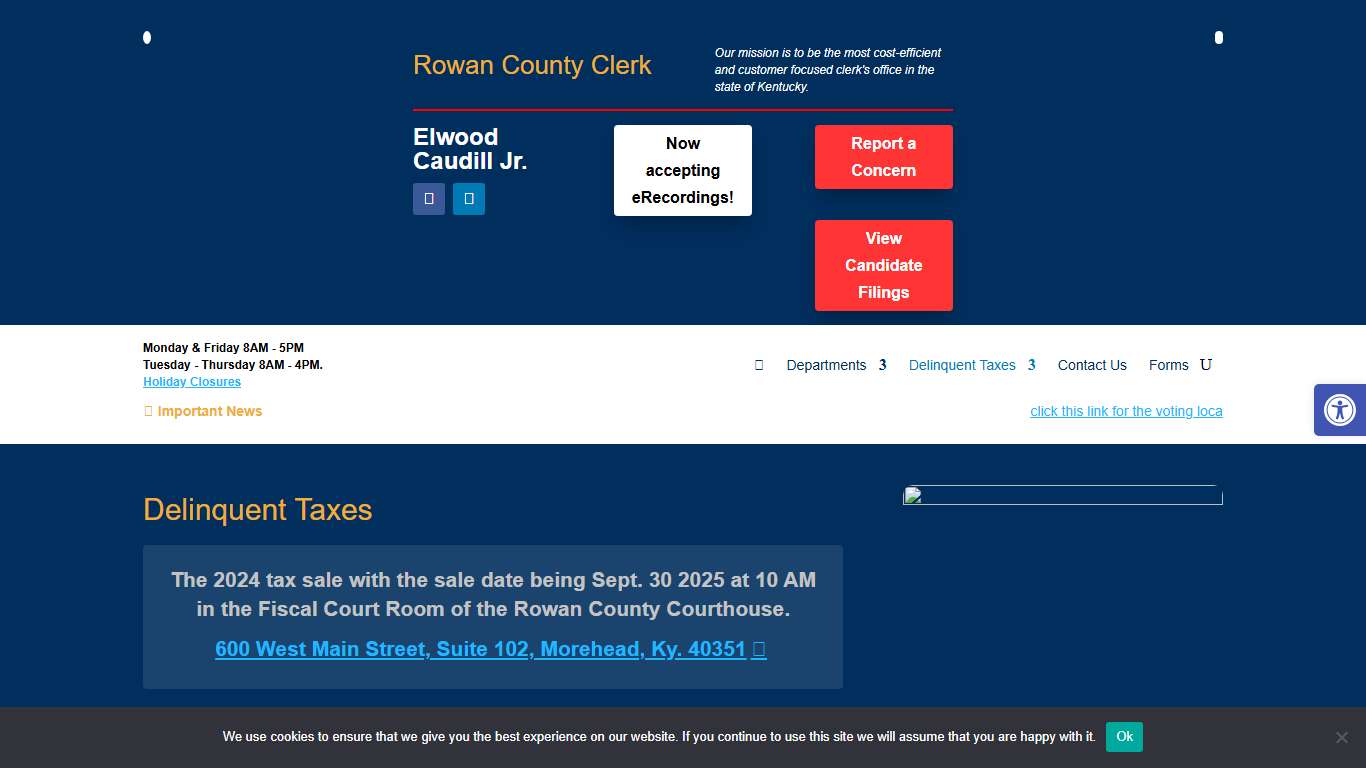

Delinquent Taxes - Rowan County Clerk

Delinquent Taxes Delinquent Property Tax Timeline Each year the citizens of Rowan County pay their annual property tax to the county. In the event, an individual fails to pay by the deadline (April 16), the property tax bill will be transferred to the Rowan County Clerk’s Office, and penalty fees will be assessed.

https://rowancountyclerk.ky.gov/delinquent-taxes/

Page Not Found

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. SmartAsset’s services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gath...

https://smartasset.com/taxes/north-carolina-property-tax-calculator

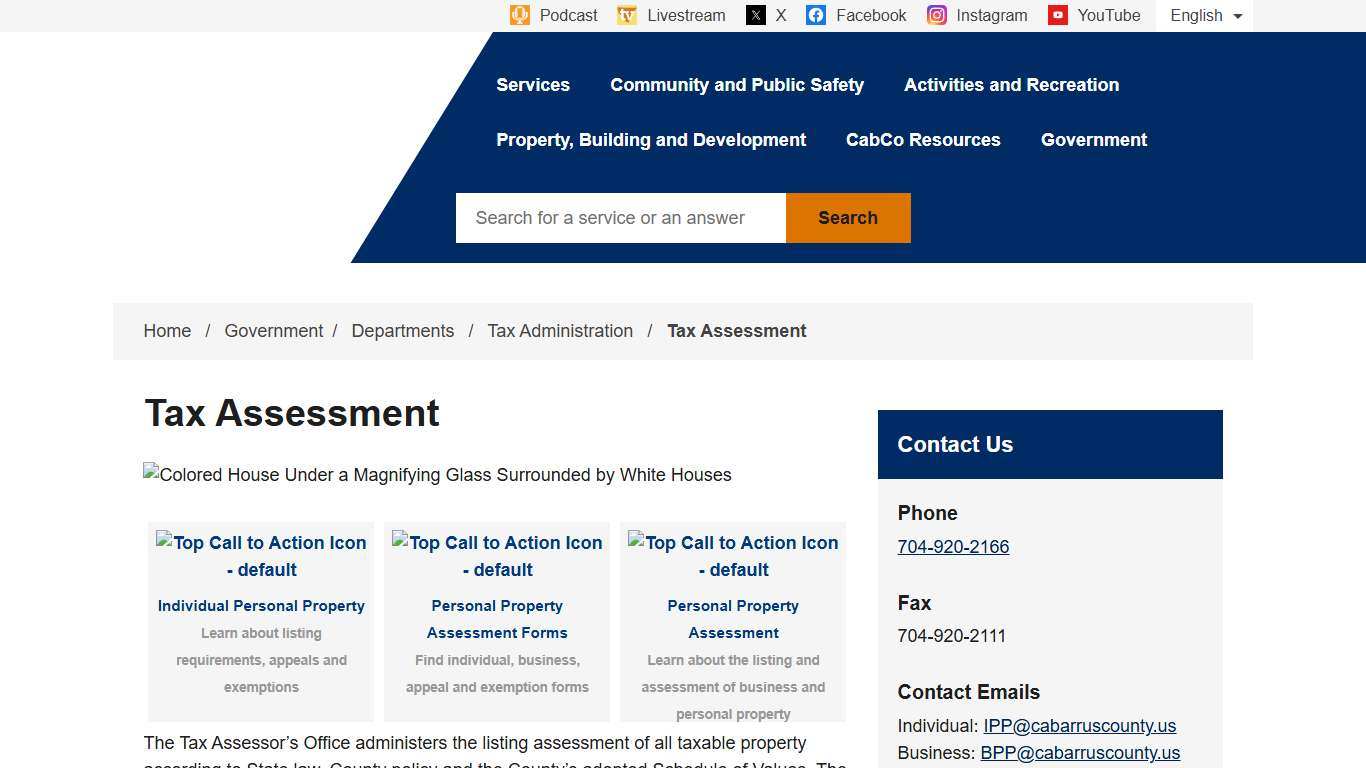

Tax Assessment Cabarrus County

Select the Escape key to close the menu. Focus will then be set to the first menu item.

https://www.cabarruscounty.us/Government/Departments/Tax-Administration/Tax-Assessment